The state’s tax revenues are expected to increase by nearly 4 percent for the next fiscal year even with the federal COVID-related relief funds coming to an end.

The state’s general fund, which finances the operations of most state agencies, has a rare surplus that presents an opportunity for further tax cuts (such as a possible elimination of the state’s income tax) or spending in vital sectors such as education or infrastructure.

The fiscal good times for the state look to continue with four months remaining in the fiscal year that ends on June 30. According to the latest revenue report from January, the state’s tax intake is more than $363 million than the same time period (July through January) last year.

According to the Joint Legislative Budget Committee’s (JLBC) budget blueprint for fiscal 2023, which begins July 1, state officials predict the state’s general fund revenues will continue to increase, going from $5.82 billion in fiscal 2023 to $7.048 billion in fiscal 2025.

That’s an increase of 7.1 percent for those keeping score at home and relies on general fund revenue growth of between 3.4 percent and 3.7 percent annually for those predictions to come true.

Legislative leaders use this blueprint to craft the separate appropriations bills for each state agency, a task appropriators save for the session's end.

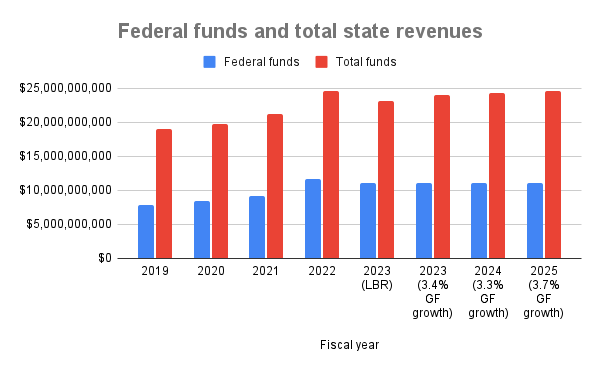

The general fund is just a small part of the pie when it comes to revenues. Federal funds still make up 47.87 percent (more than $11 billion) of the state’s $23 billion in revenues, according to the legislative budget request. Much of this revenue is the federal match for programs such as Medicaid ($5.204 billion in fiscal 2022), grants for K-12 education ($1.858 billion), and funds for programs run by the Department of Human Services ($1.273 billion in 2022) such as Temporary Aid to Needy Families.

Then there is about $5.6 billion in taxes levied to support specific agencies, known as special funds. One example of this is the state's 18.4 cent per gallon gasoline tax that goes to the Mississippi Department of Transportation.

In addition, federal money is also a big part of disaster relief through the Mississippi Emergency Management Agency ($618 million in 2022), MDOT and State Aid Road Construction office ($623 million) and the state Department of Health ($368 million).

The JLBC predicts that federal funds will remain steady at about $11 billion and special funds will remain at about $5.68 billion and that the percentage of federal funds will slightly decrease from a high of 47.87 percent (46.23 percent if the 3.4 percent in general fund growth comes to fruition in fiscal 2023) to 45.09 percent by fiscal 2025.

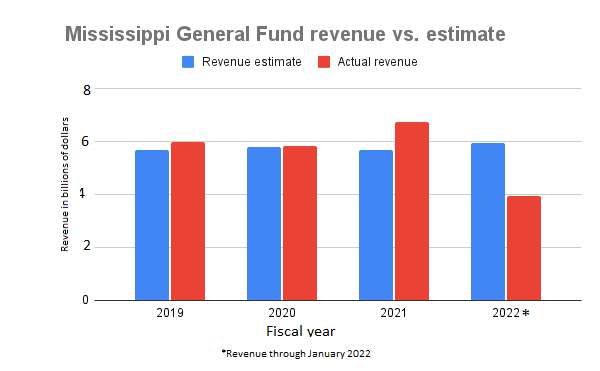

The general fund revenue estimates, after falling short in fiscal 2017 by $154 million, have been much closer to reality in recent years. They’ve also been (with the exception of fiscal 20202) on the increase as compared to the year before.

In fiscal 2019, the difference between the estimate ($5.65 billion) and the actual amount collected ($5.966 billion) was $310 million. Collections outstripped the previous year’s mark by $277 million.

The next year, the difference between the estimate ($5.802 billion) and the actual revenue ($5.815 billion) was only $13 million. Collections that year were down with $151 million less collected than fiscal 2019.

Despite the COVID-19 pandemic, the state’s revenues had their biggest bump in fiscal 2021, when the state collected $6.74 billion in revenue, $1 billion more expected ($5.69 billion). That was $924 million more than the estimate.

According to the Joint Legislative Budget Committee budget recommendation, there is $4.4 billion in unallocated funds. These include:

- $1.8 billion in federal COVID-19 relief funds.

- $1.09 billion in the Capital Expense Fund.

- $556 million in the Working Cash Stabilization Reserve Fund (better known as the rainy day fund)

- $538 million in surplus General Fund revenues

- $199.3 million in the Education Enhancement Fund, which is funded with sales tax revenues.

JLBC recommends a state budget of $6.386 billion, with a revenue prediction of $6.493 billion (some of that money is redirected into the rainy day fund and other funds for future use).

This story was changed to reflect special fund revenues.